The world’s most expensive countries to live in 2025

Revealing the costliest nations on the planet

Fed up with paying over the odds for your weekly shop, energy bills, and more? You're not alone. Post-pandemic inflation has thankfully cooled in many countries, but costs keep creeping up, making those pre-COVID days seem like a distant golden age of affordability. And in the world's priciest nations, costs have skyrocketed to astronomical levels.

With this in mind, read on to discover where day-to-day life is most expensive, based on Numbeo's Cost of Living Plus Rent Index.

All dollar amounts in US dollars.

Numbeo's Cost of Living Plus Rent Index

Last updated in the middle of this year, the index tracks the prices of essentials like groceries, utilities, and rents in 143 countries and territories, using crowd-sourced data along with official sources. It covers almost everything except for mortgages.

Super-pricey New York City is the benchmark with a score of 100. One thing to bear in mind is that the data is collated from reports in major cities within each country and territory, so the costs reflected will be higher than the actual nationwide average, given that smaller cities, towns, and rural areas tend to be cheaper.

Now on to the countdown of the 25 most expensive locations, ranked from least to most pricey when it comes to the cost of living...

25. Macao (44)

Numbeo includes Macao and Hong Kong in the index, though they're part of China. In contrast to the mainland, prices in the special administrative region are punishing, with general living costs only 66% cheaper than New York City. In Mainland China, they're 78.8% lower.

Property prices have fallen over the past few years, but rents have generally risen along with groceries, dining out, and other expenses. As CNN has noted, many employees of Macao's casinos and luxury shops are increasingly likely to commute to work from Zhuhai, the less expensive adjacent mainland Chinese city, due to mounting living costs.

Sponsored Content

=23. New Zealand (44.9)

New Zealand overall is only 55.1% more affordable than New York City, with the country’s post-pandemic cost of living crisis especially biting. According to a recent Ipsos poll, one in four New Zealanders are struggling financially, a figure up six percentage points since 2022.

Prices have surged across almost every category, including rents, groceries, and utilities, while rising unemployment has further strained household budgets. The situation has become so acute that it has triggered a mass exodus, with Kiwis emigrating in record numbers in search of better opportunities abroad.

=23. Sweden (44.9)

While Sweden is equally expensive, the average net monthly salary is 8.5% higher than New Zealand's. Swedes also benefit from a more robust social safety net, meaning cost-of-living pressures are far less intense in the Nordic nation.

Nevertheless, residents have been feeling the sting of post-pandemic inflation, particularly when it comes to food prices. Earlier this year, a mass boycott of supermarkets swept the country, as consumers protested against soaring grocery costs and alleged price gouging by major retail chains.

22. Finland (45.6)

Neighbouring Finland is marginally more expensive, according to Numbeo. Post-pandemic, Finns have endured the worst decline in purchasing power in a generation, as wages failed to keep pace with escalating prices and higher interest rates.

Public frustration translated to a 'red wave' during local elections earlier this year, widely seen as a voter backlash against the government’s austerity policies. The right-wing populist Finns Party, a key member of the ruling coalition, has borne much of the blame for backing spending cuts that have squeezed public services and hit lower-income earners hardest.

Sponsored Content

21. Belgium (45.9)

Living costs have risen sharply in Belgium post-pandemic, outpacing many other European countries. The increase has impacted the poorest Belgians the most. Last year, 11.4% of the population were described as being in a situation of material and social deprivation, up from 9.4% in 2022.

Discontent over stagnant wages and planned government reforms to pensions and labour rules prompted unions to call a general strike on 14 October, demanding fairer pay and stronger worker protections amid the enduring cost-of-living crisis.

20. France (46)

Post-pandemic cost-of-living pressures have deepened France’s political turmoil. Inflation and rising prices have fuelled voter anger, driving support for populist parties on both the extreme left and far right that promise to fight austerity and protect household incomes.

While President Macron’s government has introduced subsidies and energy caps to soften the blow, proposed spending cuts and pension reforms have sparked fierce opposition. The result is an extremely polarised parliament and a succession of prime ministers, upending the nation's political system.

19. Germany (47.6)

Russia's invasion of Ukraine and general post-pandemic inflation have hit German living costs hard. Prices for groceries and energy have jumped since 2022. But perhaps the biggest strain has come from the surge in rental costs, given that Germany is largely a nation of renters.

Despite the introduction of rent controls, prices in the nation's largest cities have increased by 50% since 2015 and have risen by as much as 80% in Berlin over the same period.

Sponsored Content

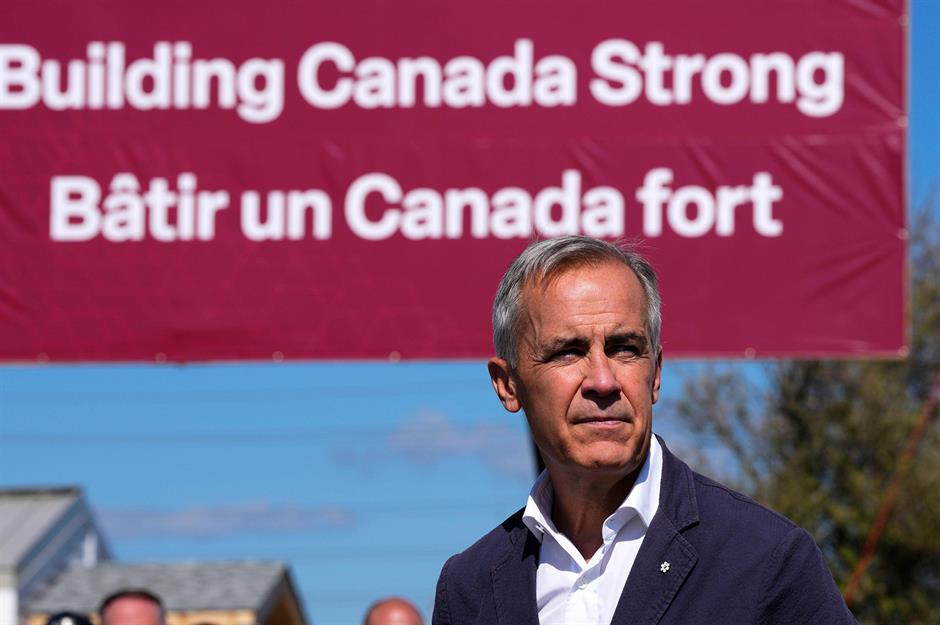

18. Canada (48.1)

Canadians have been at the mercy of an affordability crisis, which has intensified in the wake of the pandemic, with the Trump administration's harsh tariffs only adding to the woe.

Housing has surged in cost. Home prices in major cities have increased by 50% over the past decade, while rents have seen similar hikes. The cost of everything from food to childcare has also spiralled, leaving almost half the population struggling to meet everyday expenses. Prime Minister Mark Carney recently announced a series of affordability measures in a bid to ease the pressure. Whether these policy moves will be enough to turn the tide remains to be seen.

17. UAE (48.7)

The UAE’s post-pandemic boom has come with a sharp rise in living costs, especially in terms of housing. Rents in major emirates have climbed by high single-digit to double-digit percentages in recent years, according to the Dubai-based newspaper the Khaleej Times.

The government has introduced initiatives like the Smart Rental Index 2025 to help calm the market, but the surge in housing demand and modest salary growth have worn down household budgets. Employers have responded by lifting housing allowances, but affordability remains a pressing concern.

16. Austria (49.1)

Austria has faced rising prices like much of the world, with rents climbing by up to 25% between 2021 and 2023. Yet cost-of-living pressures remain relatively contained thanks to strong tenant protections and extensive social support. The coalition government has introduced a rent freeze for 2025, caps on future increases, and tighter limits on short-term leases, measures vital in a country where many rely on rented housing.

Affordable public transport, generous childcare subsidies, and public healthcare further cushion households, and indicators show deprivation levels have stabilised, underscoring how Austria’s welfare model continues to protect most citizens.

Sponsored Content

15. Australia (49.5)

Australia remains gripped by an affordability crisis, even as inflation has cooled to within the Reserve Bank’s target range. Prices for essentials, especially housing, are now far above pre-pandemic levels, with rents up 40% in major cities since 2021.

Stagnant wage growth means real incomes have yet to recover, leaving households struggling to keep pace. Around one in seven Australians now live below the poverty line, according to the Australian Council of Social Service (ACOSS). Unsurprisingly, supermarket chains such as Woolworths report shoppers increasingly turning to cheaper own-brand goods as budgets continue to tighten.

14. UK (50.6)

Four years into its cost-of-living crisis, the UK remains burdened by high prices for essentials. Everything from rents and energy bills to food continues to rise, eroding household spending power despite inflation softening and wages inching upwards. As highlighted by The Guardian newspaper, once affordable everyday luxuries, from a barista coffee to a Pizza Express meal, have become prohibitively pricey for many.

Consumer spending has understandably stagnated, with many households still struggling to recover from the biggest inflationary shock in a generation.

13. Papua New Guinea (51.6)

Papua New Guinea is among the Pacific’s most costly places to live due to factors like currency depreciation, the need to import most goods, and poor infrastructure. A typical basket of supermarket items can cost twice as much as in Australia, and just about everything else is eye-wateringly expensive.

In June, the government scrapped goods and services tax on 13 essential items, including rice, oil, and soap, to take some of the pressure off households. However, living costs remain exceedingly high in a country where many have tremendous difficulty making ends meet.

Sponsored Content

12. Israel (51.8)

The cost of living in Israel has reached a breaking point, according to an opinion piece published in The Jerusalem Post in May. Prices for housing, food, electricity, and many other basics have ballooned. The poorest Israelis are at the sharp end, but even middle-class households are feeling the pinch in a significant way – according to a recent survey, a whopping 88% have had to cut back on everyday essentials.

A major driver has been Israel's costly war with Hamas, which has harmed the nation's economy and strained government budgets, forcing significant tax hikes and other austerity measures.

11. Denmark (54.3)

Living costs in Denmark are almost on a par with Israel's, but wages are far more generous, with the average monthly net salary roughly 20% higher.

The Nordic nation has seen costs jump post-pandemic, eating into household spending power. Yet Denmark's strong welfare system has proven to be a solid buffer. And in August, the coalition government unveiled its 2026 budget proposal featuring broad tax cuts, including lower electricity taxes, the scrapping of levies on coffee, chocolate and soft drinks, VAT removal on books, and reduced childcare fees.

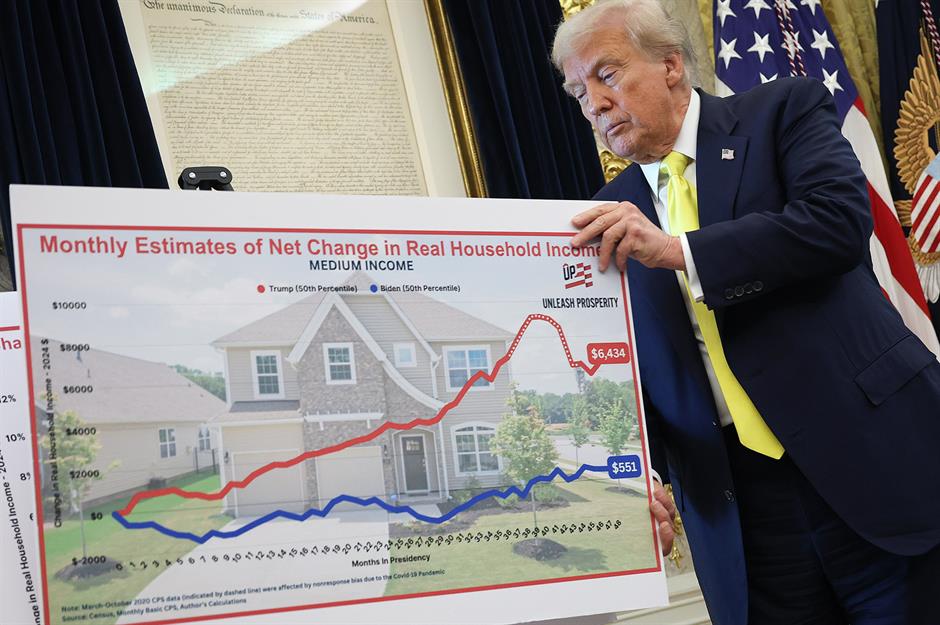

10. USA (54.6)

America's affordability crisis persists. The cost of housing, groceries, and other basics continues to squeeze households, with inflation proving stubbornly sticky.

President Trump was re-elected in large part because voters were fed up with soaring prices. But his administration has offered little tangible relief. And economists cite its wide-ranging tariffs as an inflationary factor, with the Yale Budget Lab estimating the duties will cost the average US household $2,400 (£1.8k) in 2025 alone.

Sponsored Content

9. Netherlands (54.7)

The Netherlands is battling an entrenched cost-of-living and housing crisis. Home prices are more than 10 times the median salary, while private rents in major cities have soared. Energy bills have nearly doubled since 2020, pushing over half a million households into energy poverty.

In October, a landmark collective lawsuit was filed against 10 major energy suppliers accused of unfair price hikes, reflecting public anger over out-of-control utility costs. Amid political deadlock, rival parties have called for rent freezes, tax cuts, and wage hikes to ease the pressure on Dutch households.

8. Norway (56.8)

Norway's affordability crisis has exposed profound cracks in its famed welfare model. Between 2021 and 2023, every single Norwegian household suffered a loss in economic security, according to OsloMet research.

Prices for energy, housing, and food have surged despite the nation's robust social safety net. This crisis was the key factor in the collapse of the coalition government earlier this year, triggered by disputes over soaring electricity prices and Norway’s contentious energy ties with the EU.

7. Ireland (57)

Living costs have hit the roof in Ireland post-COVID. According to a recent Ipsos/IHREC survey, 84% of the population is worried about rising costs. An analysis by newspaper The Irish Times has shown the average household is spending almost $14,000 (£10.5k) more per year compared to 2021, with the cost of housing, energy, groceries, insurance, and other staples sharply higher.

October’s Budget 2026 offered limited comfort, with only modest welfare hikes, and rent and energy tax breaks. As the Trump administration's tariffs hit growth, the Irish government is having to constrain social spending.

Sponsored Content

6. Luxembourg (62.4)

Even the well-heeled denizens of affluent Luxembourg haven't escaped the ravages of the post-pandemic cost of living crisis.

Escalating housing, energy, and food costs have steadily eroded household budgets in the wake of COVID-19. According to the latest research, they drove the national savings rate down to just 12.4% in 2024, its lowest in over a decade, and less than half the level seen during the pandemic.

5. Hong Kong (65.6)

Hong Kong remains one of the world’s priciest places to live, with housing the primary driver of its sky-high living costs. Decades of limited land supply, inequality, and speculative investment have pushed home prices and rents to extremes, forcing over 220,000 households into tiny subdivided 'shoebox', aka 'cage' flats.

Now, the government is taking action. From March 2026, new rules will outlaw these minuscule units and require minimum safety and hygiene standards.

4. Bahamas (68.7)

The Bahamas may be a tropical paradise, but it's a financial hell for locals and visitors alike. Almost everything from food to fuel is imported and slapped with steep taxes, which send prices soaring. Frequent hurricanes exacerbate the situation, disrupting supply chains and pushing costs even higher.

Housing is among the biggest burdens, with the country’s shortage of affordable homes described as one of its greatest social and economic challenges.

Sponsored Content

3. Iceland (75.2)

Iceland’s cost-of-living crisis runs deep. Prices are around 70% above the EU average, with inflation and borrowing costs near post-2008 highs. According to news site The Reykjavík Grapevine, housing is the main strain. It cites the example of rent swallowing about 60% of a teacher’s income. Home ownership is also slipping out of reach for younger Icelanders.

The Trump administration’s tariffs on Icelandic exports risk further weakening the króna and driving up prices. Elected last year, Prime Minister Kristrún Frostadóttir has vowed to restore stability, but getting living costs under control is quite the challenge.

2. Singapore (80.9)

Singapore is exceedingly expensive, with housing, transport, and healthcare among the steepest anywhere. Cost-of-living pressures dominated this year's general election. In response, Prime Minister Lawrence Wong’s government promised to roll out grocery vouchers, utility rebates, and childcare subsidies, which were no doubt instrumental in the ruling party retaining its supermajority.

Yet many residents say prices still outpace pay. Rents can gobble up over half of household income, prompting a growing number of Singaporeans and expats to relocate to neighbouring Malaysia, where living costs are up to 80% lower. The state continues to expand aid schemes, but daily expenses remain a defining political flashpoint.

Most expensive. Switzerland (82.3)

The most expensive country in the world also boasts the highest wages, according to Numbeo. Even so, lower and middle-income Swiss households are increasingly squeezed. Health insurance premiums have more than doubled in 20 years, while rents have climbed about 20% in 15 years, and home ownership remains out of reach for many. And childcare costs can easily wipe out extra earnings.

Indicative of the depth of the problem, Switzerland’s price watchdog has been logging record complaints and last year, it started convening annual 'purchasing power' summits.

Now discover the countries where debt interest payments outstrip key government budgets

Sponsored Content

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature