Brexit and house prices: the property survival guide

Whether you’re for or against Brexit, you can’t ignore it – but how is it affecting the world of property? Here's our guide on how to survive Brexit if you’re considering renovating your home, buying or selling a house, have a buy-to-let property or are just generally curious

Brexit and the property market

It's been more than three-and-a-half years since the idea of the UK leaving the European Union became a reality and after intense political activity for what felt like forever we finally left the EU on 31 January. Although this eliminates some of the uncertainty that has been affecting the economy over the last few years, a trade deal between the UK and the EU now has to be negotiated by the end of the year or we could still face a no-deal situation.

Whatever happens, Brexit has already had a profound effect on our economy and the confidence of consumers. Nobody knows exactly how it will impact the housing market and your finances in the future if you’re planning a move, buy-to-let investment or renovation project but you can prepare for the most likely outcomes.

Way back in September 2018, the governor of the Bank of England, Mark Carney, warned that leaving the EU with no deal could be catastrophic, sending unemployment soaring and house prices plummeting, but most property experts think that the effects on the housing market would be less dramatic than this.

While we have now left the EU with a deal that puts a transition period in place until the end of the year following the Conservative win in December’s general election, having no trade deal with the EU at the end of this will still have a dramatic effect as it will be harder and more expensive to sell goods and services in Europe. The UK also needs to set up deals with the other countries it previously had arrangements with as part of the EU.

Uncertainty and hesitation have had the biggest impact on the health of the housing market since the EU referendum in 2016 but, depending on your circumstances, this could be a bonus.

Brexit and house prices

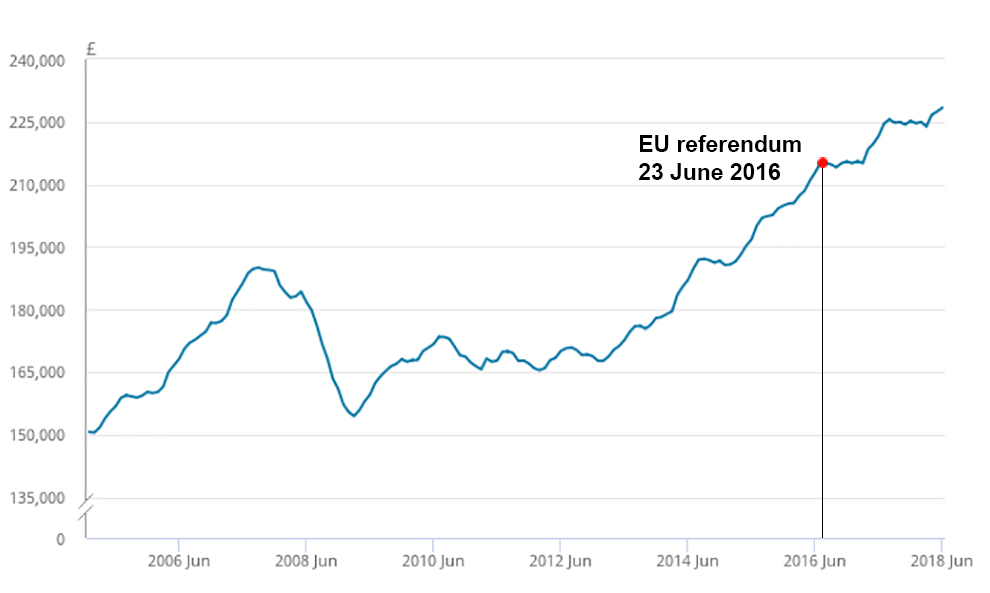

The referendum didn’t have a big effect on average UK house prices at the time and they continued to rise, albeit more slowly. Land Registry data for July 2016 showed that average UK house prices went up by 8.3% to £216,750 – less than the 9.7% seen in June 2016 but still a healthy amount. All regions of the UK continued to experience growth.

Graph shows average UK house price from Jan 2005 to June 2018. Source: ONS

Nationwide’s index showed that prices actually increased faster in August 2016 than in July (its methodology means there was a slight lag in any referendum effects showing up in the data). Despite the market slowing because of the extra 3% added to stamp duty for buyers of second homes and buy-to-let properties in April 2016, and uncertainty around the referendum, fewer properties on the market as well as fewer buyers meant that growth stayed steady.

The Halifax index showed price rises slowing down around that time but put this down to prices rising faster than earnings, reducing the demand for property.

The overall picture between then and the end of 2019 was that house prices grew more slowly than before, especially in the south and east of England, although prices still rose across much of the UK. However, the housing market has had a boost since the election, supported by good employment conditions and a still competitive mortgage market. Halifax’s data showed an annual change of 4.1% across the UK in January and a lower 2.8% in February compared to 2.1% in November.

Nationwide’s house price data shows an annual increase of 2.3% in February (compared to 0.8% in November) - the highest growth since July 2018. The building society still expects growth to be fairly flat overall in 2020 though while the UK’s trading relationships are being worked out. The coronavirus outbreak is also now expected to have a negative impact on the global economy this year.

House prices had been falling across London and the south-east of England for most of 2019 but the latest Office for National Statistics (ONS) index shows that in December they increased by 2.3% in London compared to the previous year and 1.2% in the South East. It also shows that prices increased across all regions for the first time since February 2018.

Jonathan Hudson, founder of estate agent and property consultancy Hudsons in central London, has also noticed that prices have been boosted by a slight increase in buyers since the election but still a shortage of properties to buy. He said: “Only motivated sellers who have a reason to sell are doing so as many are holding back in the hope prices will increase. The cost of stamp duty on onward purchases is holding back others and many who purchased in 2014 might not realise the same value as they originally paid for it.”

Other reasons for a shortage of new properties coming onto the market in London is that property owners from overseas are waiting for the exchange rate to improve and developers are delaying building new homes until the market gets stronger. This is likely to be short term, however – once the supply increases price rises will slow down.

Jonathan Hudson says investors from overseas are particularly keen to buy at the moment: “Many are looking at London property prices licking their lips given the current exchange rates and, although the number of UK-based buyers is now increasing, in my opinion overseas buyers will have a year at least to take advantage of this while no deal is still on the table.”

An oversupply of newbuild homes in London and less demand for buy-to-let properties were also factors in the general slowdown over the last few years. As well as stamp duty increasing for buyers of buy-to-let or second homes, the amount of mortgage interest landlords can deduct from their profits to pay less income tax has been decreasing since April 2017 and will disappear completely by April 2020, to be replaced by basic-rate tax relief only.

Other changes affecting buy-to-let include tighter lending criteria for ‘portfolio’ landlords (those with four or more mortgaged properties) introduced in September 2017.

After a fall in the number of buy-to-let investors, Jonathan Hudson has now seen it stabilise: “Most landlords are holding firm – those who were spooked by the taxation and legislation changes have sold but the majority have played a longer game knowing that property in the long term is a great investment.”

There are very few buy-to-let landlords increasing the number of properties they own or new landlords entering the market but Hudsons has seen an increase in requests to manage landlords’ assets. “This enables the property owner to protect themselves and their tenants as new legislation comes in to force, as well as cost-effectively managing their maintenance issues,” he points out.

Ian Harris, branch manager of Watsons estate agency in Norwich and the National Association of Estate Agents (NAEA) Propertymark’s regional executive for East Anglia, has seen the number of investors remain steady: “Landlords continue to enter and leave the market in roughly equal proportion but these decisions are seemingly unaffected by the sentiments or practicalities of Brexit – instead the yield, taxation and increasing legislation burden are the most frequently mentioned factors.”

The lower demand for buy-to-let properties has helped first-time buyers as they have not had to compete with investors as much for properties, so the first-time buyer market has been relatively healthy.

Some estate agents saw blips following certain Brexit-related events. Ian Harris said Mark Carney’s doom-and-gloom comments about house prices in September 2018 and the dramatic way they were reported had a big impact on transactions: “Activity dropped for 24 hours, but then returned to normal.”

However, despite the ongoing political uncertainties last year he has found the market to be resilient and although the ONS house price data for December showed prices increasing in his region he does not put this down to the election result as it came after most of the transactions for that month were agreed. “It’s more likely to be as a result of the restrained supply of stock, especially in the middle third of the year, while buyer enthusiasm, encouraged by low interest rates, was strong,” he said.

Recently, Ian Harris has found an increased enthusiasm to sell among clients. However, according to the latest Royal Institution of Chartered Surveyors (RICS) market survey, while the number of buyers in UK has gone up recently there is still a relative shortage of properties to choose from.

Charlie Kannreuther, Head of Residential for Savills estate agency in the North West and Midlands, has also found the market to be relatively robust: “Uncertainty has become something of a way of life, but the market has shown real resilience. Perhaps people are buying for the mid-term rather than for short-term gains and demand has been pretty consistent this year so far. This is reflected in a year-on-year increase in our new buyer enquiries, viewings and income.”

House prices after Brexit: what will happen?

So what’s likely to happen to house prices and the property market over the coming months? While London felt the impact of Brexit uncertainty more than many other parts of the UK prices there have started to rise again.

A Reuters poll of property experts in March 2020 predicts that house prices in the capital will rise by 2% this year and next year. Two thirds of respondents said that housing market activity in London is likely to accelerate over the coming year.

In the UK as a whole, the RICS says that house prices are expected to rise in the near term and over the coming year in all parts of the UK to varying degrees following the confidence boost from the election result.

House prices rising more quickly is not great news if you’re a first-time buyer but if you’re buying and selling in the same market you won’t be negatively affected.

The numbers of both buyers and sellers are expected to pick up, and as a result the number of sales, over the next year.

The chief executive of NAEA Propertymark, Mark Hayward, agrees: “After a period of suppressed market activity due to Brexit and political uncertainty, the clear outcome of the general election in December injected some much-needed confidence into the market. This positive sentiment was reflected in our recent January Housing Market Report figures, which showed a significant increase in demand from house hunters.”

This means that if you’re buying or selling, the time it takes to complete your transaction could speed up again and you may not have as much time to be selective and think about your decisions carefully as when the housing market was moving more slowly.

Mark Hayward would also like to see extra measures to encourage home buyers implemented. He adds: “As the spring budget fast approaches, we hope to see housing as a priority for the new chancellor. A clear strategy is needed to tackle key issues such as stamp duty costs, which needs to be addressed in its entirety to encourage more frequent moves, improve affordability and relax punitive financial tax on home movers.”

Ian Harris is cautiously optimistic: “So far employment remains high, interest rates low and lending capacity strong but let’s see how we go for the remainder of the year.”

Brexit and mortgages

As the property market slowed and there have been fewer mortgages taken out, lenders have been competing even harder for customers for both purchases and remortgaging. This means that plenty of good mortgage deals are available and lenders are keen to lend so are being flexible. However, the latest figures from the Bank of England showed that the number of mortgages approved for house purchases went up by 4.4% in January compared to December and is at its highest level since February 2016, which could be a sign that the market is picking up again.

David Hollingworth from mortgage broker London & Country Mortgages said Brexit hasn’t had a negative impact on the mortgage market for borrowers: "The Bank of England base rate fell to 0.25% after the referendum but is now only up to 0.75% so interest rates are still historically low. The direction of the base rate is hard to predict and could go either way at the moment. Nonetheless the mortgage market remains extremely competitive and mortgage rates offer borrowers the chance to lock their mortgage down with extremely low fixed rates.”

At its 1980s peak in October 1989, the base rate was 14.88%. The Bank has said that any increases over the coming months will be limited and gradual.

You can get two-year fixed-rate residential mortgages from less than 1.25% and there are lots of five-year deals under 2%, with the very lowest rates below 1.5%. The market has also become more competitive if you want to borrow a higher proportion of the property’s value and more lenders are supporting the Help to Buy scheme. This was extended to 2023 after the autumn budget but will only offer equity loans to first-time buyers from 2021.

Brexit and home improvement costs

The value of the pound fell dramatically after the EU referendum and as a result the cost of goods from the EU and elsewhere, including building materials, increased, adding to the cost of renovation work. The pound’s value is still nowhere near pre-referendum levels.

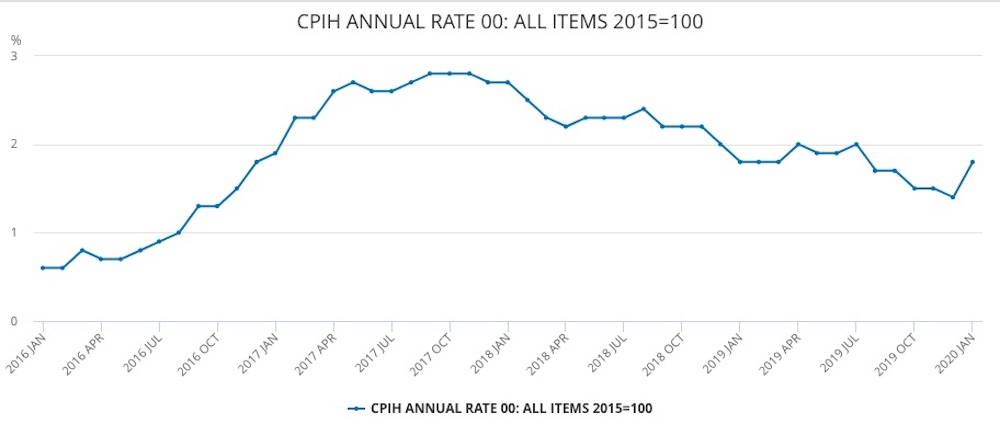

Image: ONS

Inflation was extremely low at the beginning of 2016 but increased steadily over the course of 2016 and 2017, and the Consumer Prices Index (CPI) reached a high of 3.1% in November 2017. The index tracks the prices of a range of consumer goods and services and includes the cost of maintaining and repairing a home and installing and repairing home appliances.

CPI has since fallen – it was 1.8% in January although this was up from 1.4% in December – and while growth in the UK economy is expected to pick up, the Bank of England expects inflation to remain below its 2% target this year.

Although relatively low inflation is good news if you’re planning home improvements, the building industry still expects the cost of materials and labour to rise. In the latest quarterly State of Trade survey from the Federation of Master Builders (FMB), which represents small and medium-sized building firms (those typically taking part in the survey have 10 or fewer employees), covering the fourth quarter of 2019, 84% thought the cost of materials would rise over the next six months.

READ MORE: Will home renovators count the cost of Brexit?

FMB chief executive Brian Berry said: “The decisive general election result has led to a bounce in construction workloads. Many homeowners who were holding back on home improvement projects are now starting to undertake them. However, shortages of skilled tradespeople in the construction industry have meant that salaries are rocketing; a situation that won’t be helped by the government’s new points-based immigration system, which will be introduced in January 2021.”

In the FMB survey, more than half of builders said they expected the cost of paying workers to rise over the next six months and firms are continuing to struggle to recruit certain trades – 54% said they were having problems finding bricklayers and 53% reported a shortage of carpenters and joiners.

Government figures from 2018 show that 7% of workers in the construction industry were from the EU, rising to 28% in London, but the number of EU workers in the UK has fallen dramatically since 2017. This is likely to have contributed to the rising cost of hiring builders, especially in the capital.

Despite last year’s Brexit uncertainty, it seems that homeowners were not being put off from doing renovations. The Homebuilding & Renovating Shows reported a 14% increase in the number of self-build projects underway among the visitors to its London show in October 2019 compared to 2018 and the average amount being spent on a home project increased from £120,000 to £134,000.

Property renovation after Brexit

- If you need to keep costs down, consider using cheaper materials or products than your first choices rather than scrimping on the building work itself as if you end up with a rogue trader you could end up paying more in the long run. To find a good builder, ask for recommendations from friends and family.

- Talk to your builder and tradespeople throughout your project to make sure costs won’t change significantly to what was originally estimated. “Ensure that embedded within your contract is a note saying that if there is no trade deal and material prices go up, the contract will be renegotiated and agreed on before work continues,” advises Brian Berry.

- Consider borrowing any money you might need for your renovations sooner rather than later while interest rates are low.

- Don’t delay your project if you don’t need to – it’s likely that the cost of labour and materials will continue to go up.

- Think about taking on a project manager who can get you the best deals, make sure the project runs efficiently and fight your corner with the builder if necessary. Their cost could be paid for by the savings you make as a result of their input, not to mention limiting the stress involved.

Buying a house

Nobody really knows what is going to happen as a result of Brexit over the coming months and years but follow our advice to make sure you’re prepared for any eventuality.

- Always buy with a long-term view and future-proof your purchase so that you are unaffected by short-term blips in the wider economy. For example, if you plan to have children in the future aim to buy a home that will be big enough to accommodate them now, without overstretching yourself.

- Take your time when choosing a home to make an informed decision about the area as well as the property. Is the area safe and how good are the schools if children are a factor?

- Consider fixing your mortgage for five years or more if you won’t need to move during that time so you have certainty about what you’ll be paying whatever happens to the mortgage market. You can usually take your mortgage with you if you do plan to move but there is no guarantee how much any further borrowing you need may cost you. Speak to a mortgage adviser to get the best deal for you.

- Work out your living costs meticulously when you move to make sure you can afford them now and in the future should your income decrease.

- Consider borrowing more now if you’ll need to – for renovations for example – as mortgage rates are low and there’s no guarantee they will stay that way.

Search for a cheap mortgage: you could save thousands!

Selling a house

Ultimately, if you've outgrown your place and need to move there's no real reason to wait. While there are always risks with any property deal, you can't put your life on hold. Here's how to proceed cautiously.

- Do thorough research into how much properties have sold for in your area recently so you know how much you can expect to get. You can do this by speaking to estate agents and looking at price-paid data on the Land Registry website, although prices are only recorded once the sale has been completed. Property portals like Rightmove will give you a feel for current asking prices but not the level of offers accepted.

- Shop around for an estate agent you are confident can get you the best amount without over-inflating the asking price, which could mean your home takes longer to sell.

- If you don't have to move and are worried about your job post-Brexit you could consider waiting until we know more. Unemployment is currently at its lowest since the mid-70s but it’s not clear how Brexit will affect companies and therefore jobs.

- If you're trying to move up the property ladder, you may end up with more equity to do this by holding onto the property for longer since prices are likely to start going up more quickly again. Plus, history shows that it’s usually worth hanging onto property long term – average UK house prices are now significantly higher than before the 2008 crash.

- Take steps to actively sell your home – present it as well as you can and convince potential buyers that you are a reliable seller. Ian Harris says: "Be open and transparent to give buyers confidence. Be clear about what you’re offering and your pricing."

Investing in buy-to-let

Brexit or no, times are tough for landlords, especially since the new financial year began on April 5th 2019. Be aware of new charges and changes to mortgage interest tax relief for commercial buy-to-let landlords then read on to see how Brexit could impact your interests.

- Always invest for the long term to limit how much you are affected by fluctuations in rental yields (the annual rent as a percentage of the value of the property, which indicates how much money you can make on it). Yields have fallen in areas where there are high property prices, such as London, but how much a property is worth is likely to go up in the long term. There may also be opportunities to buy investment properties for less than before.

- Make sure you could still afford to own and maintain your buy-to-let property during leaner times – if you have extended vacant periods or expensive repairs that need doing for example.

- Be a good landlord. Jonathan Hudson says: "The government is clamping down on poor landlords. Make sure you have a good team behind you so you can fix any problems with the property quickly."

- Investigate the market carefully by speaking to estate agents and doing research online before you invest in a buy-to-let property in a particular area. How much rent can you expect to get and what is the demand for rental property there? Is it seasonal because it’s a student area, for example?

- Manage your ongoing costs carefully, including making sure you can keep on top of mortgage payments. "This is more important than ever because of tax-relief changes," says David Hollingworth.

- The fall in buy-to-let investors could mean there is a shortage of rental properties in certain areas so look into whether the market rent you could charge has gone up recently.

Should you wait until the effects of Brexit are clearer?

The fact is that there could be any number of outcomes resulting from Brexit – both positive and negative – so putting your life on hold may not be the right thing to do. If you need to act now and are in a good position, it’s not worth delaying – as long as you’ve protected yourself from potential challenges in the future.

As Charlie Kannreuther advises: "Make decisions based on your own circumstances rather than what may or may not happen because of Brexit."

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature